Credit Sesame explains why credit card interest rates remain stubbornly high—and what you can do to reduce how much you pay.

Americans are increasingly worried about rising prices, and credit card interest can quietly make everyday spending even more expensive.

Compared to other major types of consumer debt, credit cards carry significantly higher interest rates. The surprising part? Much of that cost may be avoidable.

A new report from the Federal Reserve Bank of New York breaks down why credit card interest rates are so steep—and offers insights that could help you pay less.

How credit cards stack up against other debt

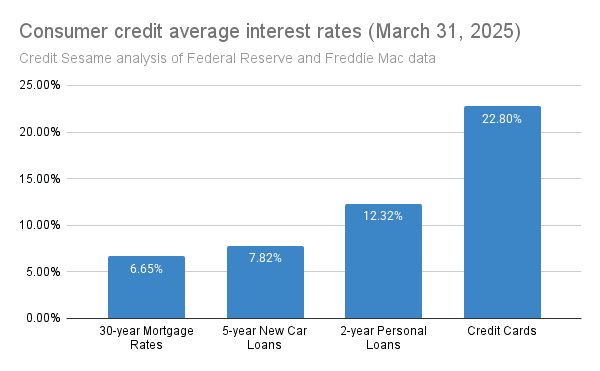

Interest rates vary widely across different types of consumer debt, and credit cards top the list. According to data from the Federal Reserve and Freddie Mac, the average credit card rate is nearly three times higher than rates for mortgages or auto loans, and roughly 10 percentage points above the average personal loan rate.

This stark difference raises the question of why credit card interest rates are so much higher. The answer lies in the interest rate spread — the difference between a credit card’s interest rate and the Federal funds rate.

The Fed funds rate reflects what it costs banks to borrow money. That rate is just a starting point. Like a grocery store that marks up the price of bread to cover operating costs and earn a profit, credit card issuers add their own layers of cost. These include risk management, operations, marketing, and a profit margin.

The recent New York Fed paper breaks down those layers, showing why the spread on credit card rates is so wide compared to other types of debt.

How credit risk drives up your rate

Credit risk is the possibility that a borrower will not repay what they owe. Most credit cards are unsecured, meaning there is no collateral, so lenders rely heavily on a borrower’s creditworthiness.

Credit card companies add a cushion to interest rates to cover the losses from missed payments. The riskier the borrower, the larger the cushion.

This plays out clearly in the data. According to the New York Fed, customers with perfect 850 credit scores paid an average interest rate 7.22% above the Fed funds rate. For those with 600 credit scores, the spread jumped to 21%.

That makes sense up to a point. Higher-risk borrowers are more likely to default, and lenders adjust their rates accordingly. But credit risk alone does not fully explain the gap.

The average interest rate spread in the study was 14.5%, while current charge-off rates — what issuers actually lose to defaults — are around 5%. Even during the Great Recession, they did not exceed 10%. So, something more than risk is keeping those rates high.

The hidden cost of credit card marketing

The New York Fed study found that marketing costs are a significant reason for high credit card interest rates.

Credit card issuers have substantial operating expenses, and marketing is a big part of that. As a share of assets, these banks spend about 10 times more on marketing than other banks.

Think about how often you see credit card ads—and how many feature celebrity spokespeople. Prime-time ad slots and big-name endorsements are not cheap. Those costs get passed along through the interest rates that cardholders pay.

Inflation risk and rate caution

Although not addressed in the New York Fed study, inflation risk may be a growing factor behind persistently high credit card rates.

In theory, inflation is already baked into the Fed funds rate and should not affect the interest rate spread. However, credit card rates have not fallen as quickly as inflation or the Fed funds rate. In the third quarter of last year, the Fed funds rate dropped by 1%, yet average credit card rates fell by only 0.57%.

Credit card issuers were caught off guard by the inflation surge of 2021 and 2022. Because laws limit how fast they can raise rates, many seem hesitant to lower them now, worried that inflation could spike again.

How to cut the cost of credit card interest

Whatever the cause, carrying a balance on your credit cards can get expensive. Here are three practical ways to reduce how much you pay:

- Pay down your balance. Interest charges only apply when you carry a balance. The more you pay off each month, the less interest you owe.

- Compare your options. Credit card companies spend heavily on advertising, but the best deal is not always the loudest. Look beyond the promos to find cards with lower rates and better terms.

- Improve your credit score. As the Fed study showed, credit risk plays a big role in how much interest you are charged. A higher score could qualify you for significantly lower rates. Get your free credit score now.

Credit card companies set high interest rates to cover various costs, including credit risk and marketing. But while those rates may reflect their bottom line, they impact yours too. If you carry a balance, even small purchases can grow more expensive over time. The good news is, you are not powerless. By paying down balances, comparing card offers, and improving your credit score, you can take control and reduce the amount you spend on credit card interest.

If you enjoyed Why credit card interest rates are high and how to pay less you may like,

Disclaimer: The article and information provided here are for informational purposes only and are not intended as a substitute for professional advice

Read the full article here