Does your paycheck show up in your bank account and then just . . . vanish? Yep, been there. But zero-based budgeting can fix that!

With a zero-based budget, you’re giving every single dollar a job on purpose. It’s hands down the best way to take control of your money and feel confident every time you spend.

I’ll walk you through exactly how zero-based budgeting works and how to create one—so you can stop wondering where your money went and start telling it where to go.

What Is a Zero-Based Budget?

A zero-based budget means your income minus your expenses equals zero. That’s it. You tell your money where to go—before you spend it.

No, it doesn’t mean you drain your bank account to $0 every month. It just means every dollar has a job—whether that’s giving, saving, spending or paying off debt. (And it’s a good idea to have a buffer of at least $100–300 in your checking account as your built-in budget safety net.)

For a deeper dive into the zero-based budget, let’s hear from my friend and co-host of The Ramsey Show, Jade Warshaw:

How to Make a Zero-Based Budget: 5 Simple Steps

- List your monthly income.

- List your expenses.

- Subtract your expenses from your income to equal zero.

- Track your expenses (all month long).

- Make a new budget (before the month begins).

1. List your monthly income.

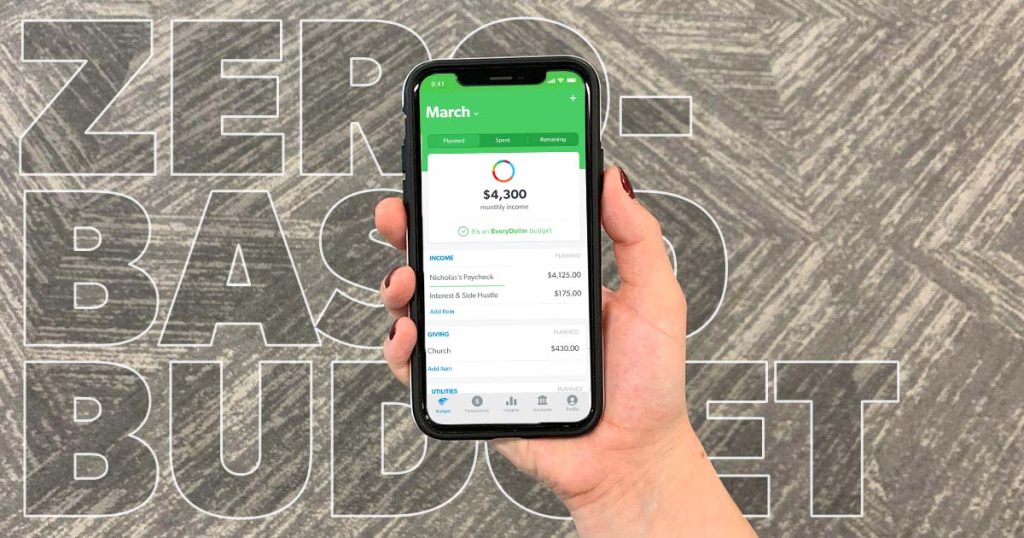

You can list your income the old-fashioned way with a sheet of paper. But I like to use a budgeting app like EveryDollar where I can easily plug in and change the numbers in my budget.

So, what counts as income? Your regular paychecks and anything extra you plan to bring in during the month—like cash from your side hustle as a delivery driver or balloon artist for kids’ parties. Write it all down and add it up! That’s your total monthly income, aka what you’ve got to work with this month.

2. List your expenses.

All right, now you know what’s coming in—so it’s time to plan what’s going out. List everything you spend money on in a typical month. And I mean everything. Not just the bills. (Scroll through your bank account or check your latest bank statement to see where your money’s really going.)

List your expenses in this order:

- Giving. Start with generosity. I recommend 10% of your income here—it sets the tone for your budget and keeps you focused on what really matters.

- Saving. Pay yourself first. Whether it’s building your emergency fund or saving for something big, make this a priority. (Quick note: If you’ve got debt, throw that savings money at your debt snowball first. Knock it out before you build!)

- The Four Walls. Budget for the basics first: food, utilities, housing and transportation.

- Other expenses. Once the big stuff is covered, add in things like insurance, debt payments, childcare and all the other stuff—fun money, subscriptions, random Amazon orders.

3. Subtract your expenses from your income to equal zero.

Once you subtract all those expenses from your income, the goal is simple: Hit zero. Didn’t get it right on the first try? Welcome to the club. No one nails it on the first pass—and that’s totally fine.

Here’s how to fix it so you’ve got a zero-based budget:

Got money left over?

First of all—celebrate! Toss some confetti and do a victory dance (or if you’re a terrible dancer like me, a solid fist pump will do).

Then put that money to work. Where? Straight in your current Baby Step. What’s a Baby Step? Glad you asked. The 7 Baby Steps are your proven step-by-step plan to save money, pay off debt, and build real wealth.

So, if you’ve got any extra cash in your budget, throw it at whatever Baby Step you’re currently on. That’s how you make serious progress toward your money goals.

What if you’re in the red?

If your expenses are higher than your income, that’s a red flag—but don’t panic. You just need to make some cuts.

Grab those metaphorical clippers and start trimming your budget. You can lower some spending categories or cut others entirely. (I’d start by slashing that restaurant budget. Learn to meal plan and keep yourself out of the drive-thru. Your wallet will thank you.)

Still not enough to cover your expenses? Time to boost that income. Pick up a side hustle, sell some stuff, or get creative. Be a sign spinner, car detailer or neighborhood dog walker—I don’t care. If it pays, it plays.

That’s how you build a zero-based budget. But I’ve got two more steps that’ll help you actually stick with it.

4. Track your expenses (all month long).

When it comes to zero-based budgeting, you can’t just set it and forget it. That budget you built? It’s not a decoration—it’s a tool. And tools only work if you use them.

So, track every transaction. Every single one.

When money comes in—log it. When it goes out—track it in the right budget category. Made $100 from a side hustle? Drop it in your income. Paid rent? Subtract it from housing. Filled up your tank? That goes under gas in Transportation.

Tracking your expenses is how you stay on top of your money. This is how you avoid overspending and wrecking your budget.

Want to make tracking easier? Use the premium version of EveryDollar! It links to your bank so your transactions stream right in. Then it’s just drag, drop, done.

5. Make a new budget (before the month begins).

Your budget might not change a lot month to month—but it will change. That’s why you need to create a brand-new zero-based budget. Every. Single. Month.

Plan ahead for month-specific expenses (birthdays, holidays, school supplies) so they don’t sneak up and wreck your plan.

And don’t wait until you’re halfway through the month to do this. Make a plan for your money before the month starts—so you’re in control from day one.

If you still need some help getting started, try out our budget calculator below.

Zero-Based Budget Example

Let’s break this down with a super simple example so you can see exactly how a zero-based budget works in real life:

Income

Paycheck 1: $2,200

Paycheck 2: $2,200

Side Hustle: $600

Income Total: $5,000

Expenses

Giving: $500

Food: $650

Utilities: $200

Housing: $1,250

Transportation: $300

Insurance: $850

Debt: $1,000

Fun Money: $150

Miscellaneous: $100

Expenses Total: $5,000

Income ($5,000) – Expenses ($5,000) = Zero

Advantages of Zero-Based Budgeting (and Why It Beats Other Methods)

Zero-based budgeting gives you total control over your money—every single month. Unlike other budgeting methods, it’s flexible, focused and works no matter where you are in your financial journey.

Here’s how zero-based budgeting stacks up against other budgeting strategies:

Zero-Based Budgeting vs. the 50/30/20 Rule

The 50/30/20 rule splits your income into fixed percentages: 50% for needs, 30% for wants and 20% for savings.

Sounds simple, right? But here are some of the problems with the 50/30/20 rule:

- If you’re following the Baby Steps, you’re not always saving—you could be paying off debt. You’re laser-focused on one goal at a time. That’s how you win fast.

- This method includes debt in the “needs” category but only suggests minimum payments. That won’t get you anywhere fast.

- It doesn’t adapt to your situation. Whether you’re drowning in student loans or debt-free and investing, the ratios stay the same. That’s not helpful.

- And the math? Off. Most Americans spend more than 50% of their income on needs.

Bottom line: 50/30/20 sounds cute, but it doesn’t reflect real life—or real money goals.

Zero-Based Budgeting vs. the 60% Solution

This method says to live on 60% of your income and save the other 40%. That 40% then gets split up into retirement, long-term savings, short-term savings and “fun.”

Here’s the issue with the 60% solution:

- That’s a lot of dividing.

- If you’re in Baby Step 2, saving isn’t your priority—debt payoff is.

- Once debt is gone, then you should build your savings. Then you should invest 15% in retirement. There’s a clear order that the 60% method doesn’t account for (but zero-based does).

And again, this plan doesn’t work for most people’s real-world budgets.

Zero-Based Budgeting vs. Reverse Budgeting

Reverse budgeting prioritizes savings first, then spending. Cool idea in theory—but not always in practice.

- Love the savings-first mindset.

- But if you’re focused on killing debt (hello, Baby Step 2), this doesn’t match your goal.

- Like most budgeting methods, it assumes a one-size-fits-all approach. Zero-based budgeting adapts to you.

Zero-Based Budgeting vs. Set-It-and-Forget-It Budgeting

This method is basically: Write your income and expenses down once . . . and hope for the best.

- It’s a nice starting point, but that’s it.

- There’s no tracking, no adjusting and no accountability.

- It leads straight to overspending and budget failure.

Zero-based budgeting? Total opposite. You track, adjust and stay engaged all month long.

Why a Zero-Based Budget Is the Most Effective Type of Budget

Zero-based budgeting is flexible, focused and built for real life. It lets you:

- Prioritize your current Baby Step

- Adjust your plan every month

- Give every single dollar a job

- Stay accountable and in control

It’s not about guessing. It’s about being intentional. That’s why zero-based budgeting works—and why I’ll keep talking about it until everyone’s doing it.

The Best App for Zero-Based Budgeting: EveryDollar

If you’re doing a zero-based budget, you need a tool made for it—and that’s EveryDollar.

EveryDollar was built specifically for zero-based budgeting. It helps you give every dollar a job, track your spending, and stay on top of your plan—all in one place.

You make the money. EveryDollar helps you make a plan and do the math. No spreadsheets. No guesswork. Just a clean, simple way to stay in control of your money.

Start your zero-based budget today (for free!) with EveryDollar.

Read the full article here