milan2099/GettyImages; Illustration by Hunter Newton/Bankrate

Key takeaways

- You can add an authorized user to your Chase credit card account by completing an online form.

- You can remove an authorized user by calling Chase or sending a secure message.

- Some Chase credit cards allow you to add authorized users for no additional cost, but some may charge a fee.

As a credit card account holder, there are several reasons to add an authorized user to your account. Maybe you want to earn rewards on purchases a family member makes, or perhaps you want to help your college student build some credit history without having them create a separate account.

Regardless of the reason, the decision to add an authorized user to your credit card account isn’t one you should take lightly. When you add an authorized user to your credit card, you are responsible for repaying every dollar in charges they rack up.

Here’s how to add a trusted family member, spouse or partner to your Chase credit card account.

What is an authorized user, again?

An authorized user is someone you add to your credit card account. Once added, they will receive a credit card with their name on it, and they will be able to use it for purchases just like you use yours. However, all charges on your account will appear on the same credit card bill under your name.

Although adding an authorized user to your credit card account carries some inherent risk, many people take this step with people they trust.

How to add an authorized user to Chase

Step 1: Log in to your Chase account

The first step to adding an authorized user to your Chase credit card is to log in to your Chase account and select the credit card account you want to share with your authorized user.

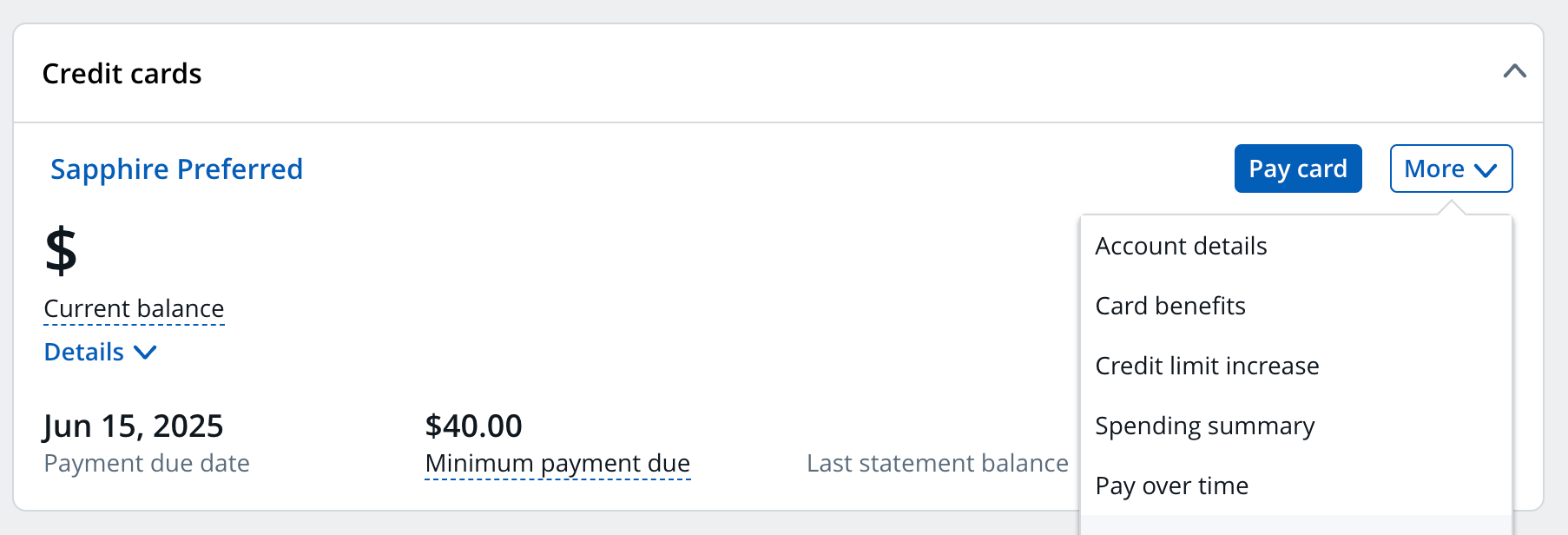

Step 2: Select ‘More’

EXPAND

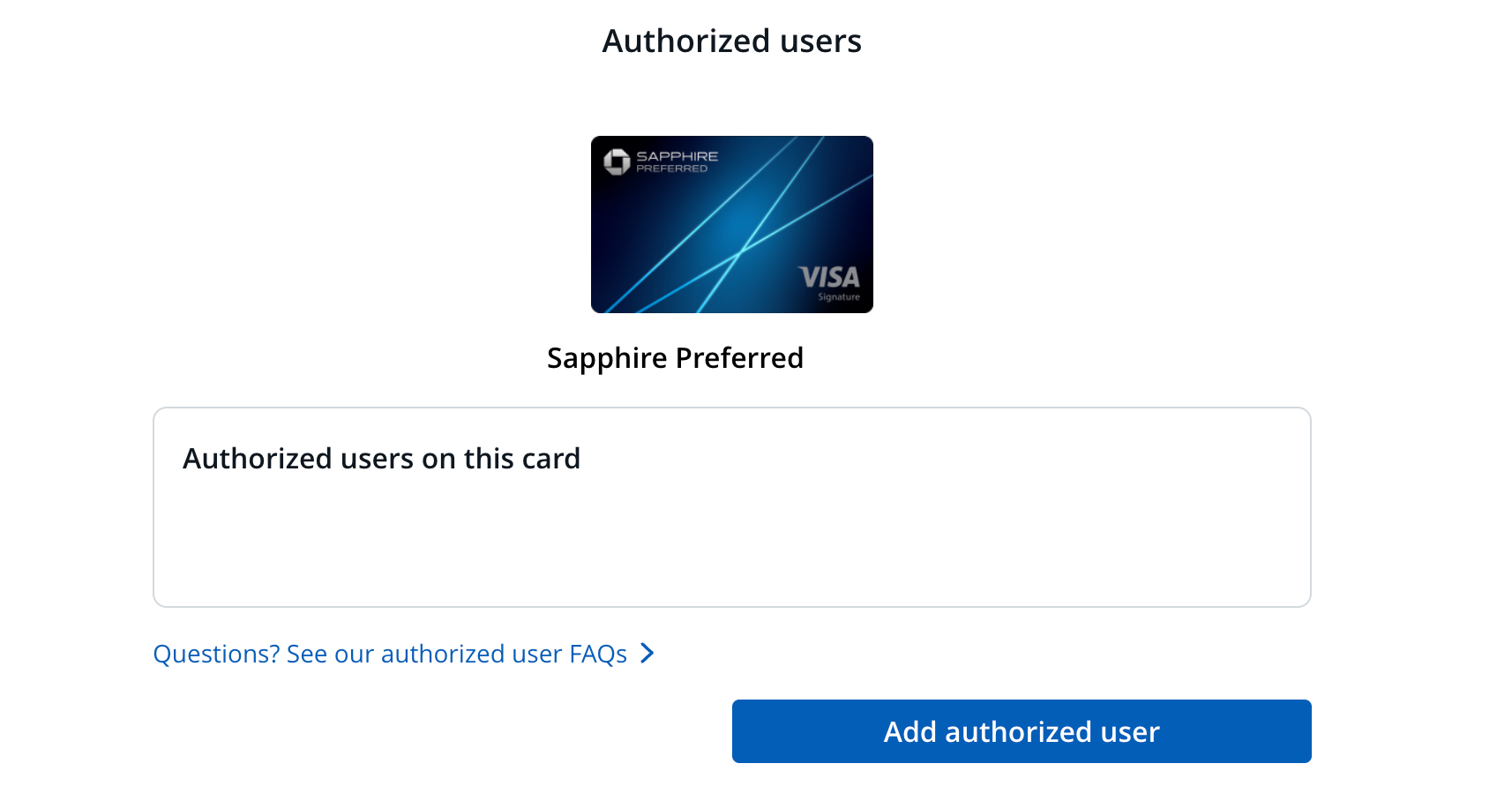

Step 3: Select ‘Add authorized user’

EXPAND

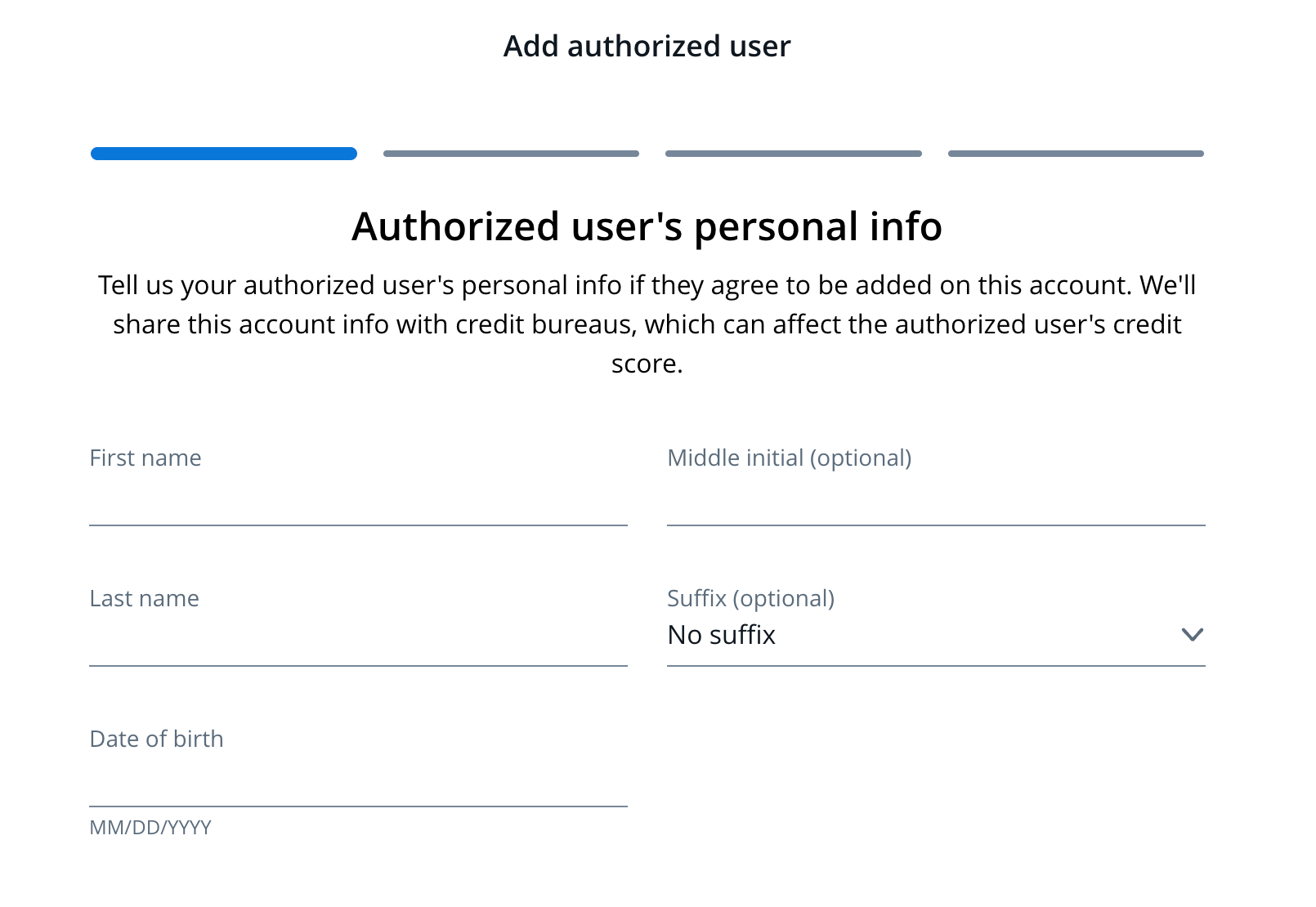

Step 4: Complete form to add an authorized user

EXPAND

You’ll need to provide the following information to add an authorized user to your Chase credit card account:

- Your authorized user’s name

- Their date of birth

- Their address

Once you fill out the Chase authorized user form, Chase will mail the authorized user’s physical credit card to the primary cardholder’s address.

How to remove an authorized user from Chase

While you can add an authorized user to your Chase credit card account online, you can’t remove an authorized user through your account management page. This means that if you want to take someone off your account as an authorized user, you’ll have to call Chase using the number on the back of your credit card instead.

Another option is sending Chase a secure message, which you can do on your account’s management page by clicking on the “Main Menu” icon and heading to your secure messages inbox. From there, you can write a new message that includes details on the authorized user account you want to close.

Which Chase cards allow you to add or remove authorized users?

Chase allows cardholders to add authorized users to their credit card accounts, although their business credit cards let you add employee cards instead. While adding an authorized user does not typically have a cost, some of the best travel and rewards credit cards from various issuers require an authorized user fee.

The following chart shows which of the most popular Chase credit cards let you add and remove authorized user cards to your account and how much you can expect to pay in fees for each person you add.

The bottom line

Adding an authorized user card to your Chase account is a big step, so make sure you know what you’re getting into. Getting a friend or relative their own card may seem generous and easy, but paying off the charges they rack up if they aren’t responsible won’t be much fun. Only add authorized users to your account if you trust them completely, and monitor their spending to ensure their new credit access doesn’t get out of hand.

Frequently asked questions about Chase authorized users

*Information about the Chase Freedom Flex® has been collected independently by Bankrate. Card details have not been reviewed or approved by the issuer.

Read the full article here