Feeling overwhelmed by money problems? You’re not alone. With U.S. household debt reaching $ 18.20 trillion dollars1, financial stress is affecting more Americans than ever before. Nearly 50% of adults report feeling stressed or anxious about their financial situation, according to a 2024 survey from Motley Fool Money.

Key Insight

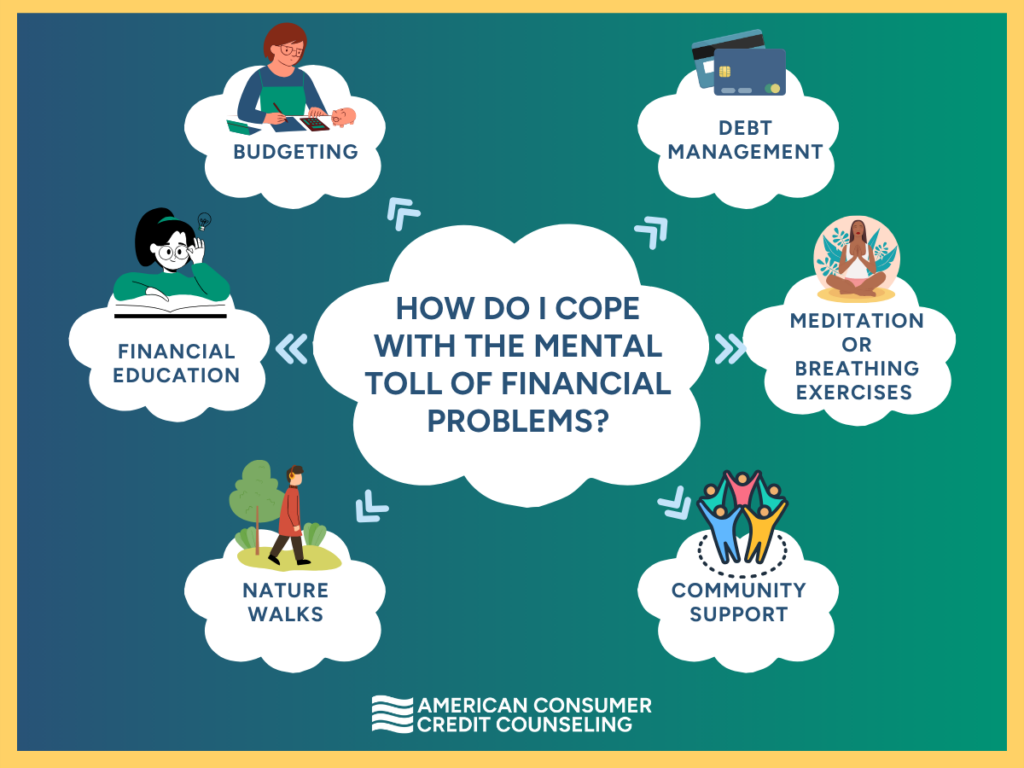

Coping with the mental toll of financial problems involves a mix of financial strategies (like budgeting and debt management) and emotional tools (such as meditation, community support, and physical activity). Seeking professional help both financial and mental can make a significant difference.

For information on debt management programs, contact ACCC.

Understanding the Mental Impact of Financial Stress

Financial stress can manifest in various ways, affecting both mental and physical health. Common symptoms include constant worry, sleep disturbances, irritability, and difficulty concentrating. Over time, these issues can lead to more serious mental health concerns such as anxiety disorders or depression. Recognizing these signs early and taking proactive steps to manage them is crucial for maintaining overall well-being.

Please remember that these responses are common and that there is no shame in seeking support to alleviate the burden.

Can Financial Issues Impact My Relationships?

Yes, the mental burden of financial stress can significantly strain your relationships, often resulting in arguments. It may also lead to diminished communication, as individuals might feel embarrassed or overwhelmed by their financial circumstances. Additionally, limited funds for social events can cause people to withdraw from their loved ones, isolating themselves instead of reaching out. This lack of communication can further exacerbate feelings of isolation and helplessness.

How Financial Stress Impacts Physical Health

Unchecked financial stress can also manifest in physical health. The BetterHelp Editorial Team and Nikki Ciletti note that,

“Like many other types of stress, financial stress can lead to physical health issues. People experiencing stress might have headaches and migraines or digestive problems like stomach cramps, bloating, and irritable bowel syndrome (IBS). Chronic stress can contribute to persistent muscle tension and pain, insomnia, poor-quality sleep, or high blood pressure.”3

It’s crucial to recognize these signs early and address them proactively. Taking small, manageable steps to improve your financial situation can alleviate stress and promote overall well-being.

Remember, taking care of your financial health is an essential component of maintaining a balanced and healthy life.

What are Some of the Coping Strategies For Financial Stress

To effectively manage the mental impact of financial stress, it’s essential to combine practical financial strategies with emotional coping techniques. Here are some actionable steps you can take:

Get Active, Problem Solving:

- Financial Education: Gaining a better understanding of personal finance can empower you to make informed decisions and reduce anxiety. Consider taking free online courses, attending workshops, webinars, or reading books on budgeting, saving, and investing. Knowledge is a powerful tool in regaining control over your financial situation. Don’t know where to start? Check in with your local library for books and upcoming community classes.

- Budgeting: Creating a detailed budget can help you gain clarity over your finances. List your income, expenses, and debts to identify areas where you can cut back and allocate funds more effectively. A well-structured budget provides a roadmap for managing expenses and reducing debt, alleviating some of the financial stress. Make it a habit to regularly review and adjust your budget; it should be flexible enough to accommodate the changes in your life.

- Debt Management: If you’re struggling with credit card debt, consider reaching out to a nonprofit credit counseling agency like American Consumer Credit Counseling (ACCC). They can help you create a personalized debt management plan that consolidates your debts into a single monthly payment, often with reduced interest rates. This approach simplifies the repayment process and can relieve financial pressure. Having a strategy to eliminate your debt can alleviate stress and anxiety, as it allows you to visualize the finish line ahead.

Emotional and Mental Coping Techniques

- Mindfulness and Meditation: Incorporating mindfulness practices, such as meditation or deep breathing exercises, into your daily routine can help reduce stress and improve mental clarity. These techniques encourage relaxation and provide a mental break from financial worries, allowing you to approach challenges with a calmer mindset.

- Physical Activity: Engaging in regular physical activity, whether it’s yoga, a brisk walk, jog, or a workout session, can have a positive impact on your mental health. Exercise releases endorphins, which act as natural mood lifters, helping to reduce stress and anxiety.

- Community Support: Joining community groups or support networks can offer a sense of connection and understanding. Sharing experiences and solutions with others facing similar challenges can provide emotional relief and practical advice. Consider participating in online forums or local meetups focused on financial wellness and mental health.

- Nature Walks: Spending time in nature has been shown to reduce stress and promote relaxation. Taking regular walks in a park or natural setting can provide a peaceful respite from financial concerns, helping you to reset and recharge.

What if I still feel the mental toll of financial problems? Seek professional help.

If financial stress becomes overwhelming, don’t hesitate to seek professional help. Mental health professionals, such as therapists or counselors, can provide guidance and support tailored to your situation. They can help you develop coping strategies and work through any emotional barriers related to financial stress.

Key Takeaways

Coping with the mental toll of financial problems requires a balanced approach that addresses both financial and emotional aspects. By combining practical financial strategies with mental health practices, you can reduce stress and anxiety, improving your overall well-being. Remember, it’s important to take one step at a time and seek support when needed, knowing that you’re not alone in your journey toward financial stability and peace of mind. Managing financial stress is a journey, not a destination. Be patient with yourself and recognize that progress takes time. If you find yourself struggling, don’t hesitate to reach out for professional support—both financial and emotional—to guide you on your path to recovery.

Frequently Asked Questions

Can financial stress cause health problems?

Yes. Chronic financial stress can lead to physical conditions like high blood pressure, insomnia, and digestive issues.

Is financial anxiety common?

Very. Surveys show that about 1 in 2 Americans feel anxiety related to their financial situation.

What’s a debt management plan?

It’s a structured repayment plan—offered by nonprofit agencies like ACCC—that helps you pay down unsecured debt through one monthly payment, often at a lower interest rate.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.

Sources:

-

Federal Reserve Bank of New York – Household Debt Report (Q1 2025)

-

Motley Fool – 2024 Financial Stress & Mental Health Survey

-

BetterHelp – Financial Stress Relief Strategies

Read the full article here