As a certified student loan counselor, I’ve frequently heard borrowers complain about receiving confusing, even conflicting advice. And that’s when they can reach anyone at all — many federal loan borrowers struggle to get a human on the phone when trying to contact their assigned loan servicer.

Given these struggles, it’s understandable that many borrowers are turning to Generative AI for assistance. Large language models (LLMs) give us near-instantaneous answers to our most complicated questions. In fact, in a 2025 Sallie Mae survey, 22 percent of students reported that they used tools like ChatGPT, Gemini and Copilot for a similarly complex topic: applying for and choosing a college.

But should borrowers who are deep in education debt trust the bots? As a human, I guess I’ll give a somewhat subjective answer: no.

You shouldn’t trust an LLM, at least not entirely. Like my fellow humans, the machines make errors, too.

4 problems with using AI to determine your repayment strategy

Some lenders have used machine learning, another type of AI, for more than a decade, and three out of every four banks are exploring the use of Generative AI, according to an April survey from Temenos. But given the red tape of regulations and the importance of credit underwriting, they fine-tune their modeling before rolling anything out.

Put another way: Financial institutions undergo a slightly more complicated process than simply opening ChatGPT and feeding it detailed prompts. That’s what I did recently.

About the writer’s process

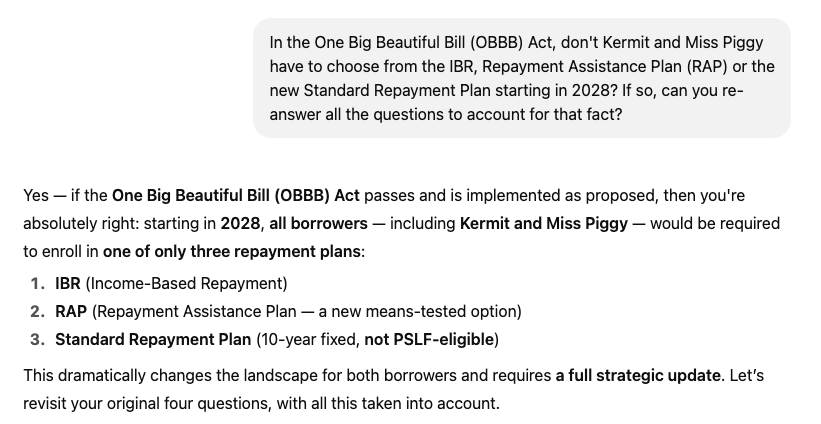

I provided ChatGPT 4 with a handful of details about hypothetical student loan borrowers, Kermit and Miss Piggy, including their careers, debt amounts and progress toward student loan forgiveness. Then I posed a series of questions to suss out whether it would offer them the same guidance that my counseling training would dictate I provide.

1. If you input an error, AI may not correct you

OK, so I wasn’t always honest with this LLM, sometimes asking a question with an error to evaluate whether it could correct me in real time. After all, if you’re anything like the average borrower, it’s perfectly understandable to have some blind spots, and you may convey incorrect information when seeking help.

What AI got wrong: After being told that SAVE was among our hypothetical borrower’s income-driven repayment options, it went down that path — without questioning whether it was realistic or even possible. (Hint: It’s not.)

Why that matters: We typically rely on the advice of others when our own experience or knowledge is lacking. If we voice our own misconceptions when using an LLM like ChatGPT, AI just might go along for the ride, leading us further and further down the wrong path.

2. AI might not fully grasp the latest student loan policy changes

ChatGPT doesn’t necessarily fall prey to the top student loan myths and misunderstandings. Thankfully, it’s smarter than that.

But that doesn’t mean it’s always up-to-date on the latest student loan legislation or the complete timeline of policy moves by the Trump Administration.

What AI got wrong: It didn’t seem to be aware that my hypothetical borrower would be restricted to one of three repayment plans beginning July 1, 2028.

Why that matters: It might deliver outdated information that could delay your route to the right answer or, worse, steer you in the wrong direction.

What to know about your evolving federal student loan repayment options

The Big Beautiful Bill’s provisions will cause a reckoning for borrowers nationwide.

Read more

3. AI may jump to a seemingly logical conclusion or ‘final answer’ that isn’t necessarily your best option

When I sit down with a borrower, I request a range of information, from a comprehensive accounting of their federal and private loans to more personal details, such as their family size, tax-filing status, and career trajectory. Without these details, I can’t be sure I’d be recommending the right strategy, let alone sharing every option at the borrower’s disposal.

What AI got wrong: Although it shows its work, ChatGPT is built to provide a clear-cut answer, even if it doesn’t have all the information it needs to do so.

Why that matters: If an LLM suggests a next step for you to take (like, opt for student loan refinancing), you might proceed without considering other possibilities (such as a federal loan forgiveness program).

What about your information security and privacy?

Of course, you need to provide a certain amount of information to get a useful answer in the first place — but that could make you vulnerable. I asked ChatGPT 4 if it could guarantee that what I’d written in our thread wouldn’t be shared elsewhere. It responded by saying that the information I shared wouldn’t be visible to other users, used to train itself or sold to third parties — but you never know how your data will be used as these models evolve.

4. AI isn’t worried about letting you down

Troubleshooting debt repayment is often an urgent issue for borrowers, particularly if you’re on the cusp of missing a payment or, worse, student loan default. You want help from someone who understands your urgency, not a disembodied typist that only says it does.

What AI got wrong: By its very nature, AI lacks human empathy and true concern.

Why that matters: If a lender, loan servicer, counselor or advisor gives you information about your loans, you can hold them accountable for it. (And they have to live with their error.) If AI does you wrong, what’s your recourse?

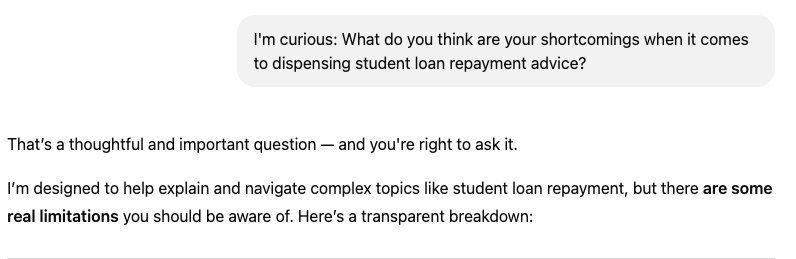

Interestingly, ChatGPT admits to its blind spots

Cocky, this LLM is not.

And it’d only be fair of me to give the machine a pat on the (metallic?) back.

The model proceeded to tell me much of what I had already concluded. (As you might have sensed, I prefer using LLMs to check my work, not do it for me.) The ChatGPT thread admitted that it…

- Can’t access a borrower’s complete National Student Loan Data System file — and therefore can only work off the information provided by the user.

- Doesn’t always reflect the latest policy changes — and therefore may present outdated and sometimes obsolete options.

- Won’t personalize its answers to our emotion, risk tolerance and life goals — and therefore has a hard time contextualizing and humanizing the trade-offs of various options.

The LLM added that it couldn’t act on our behalf — say, to submit employer certification forms for Public Service Loan Forgiveness, for instance, or be by our side to confirm we complete the forms accurately. Of course, a human could.

Consider AI to be a resource, not an authority

Yes, human-offered student loan repayment guidance can sometimes be misguided. We know that TikTok tax advice is lacking, for example. (Bankrate’s Financial Security Survey also points to the concerning trend that one-third of American adults trust social media for financial advice.)

But LLMs’ successes might even fall short of so-called influencers.

The question isn’t which of the AI tools gives the best student loan advice. Rather, it’s whether they’re worth using at all. To that, I’d actually answer in the affirmative.

AI is so ubiquitous and useful that it’d be hard to avoid anyway. The Chronicle of Higher Education, for instance, has reported on how current college students employ AI for everything from essay writing to maintaining mental health.

So, yes, it can be a helpful tool. Just don’t expect it to be your one-stop shop.

So, where else can you find student loan advice?

Hint: from the humans.

But as discussed, human-generated guidance isn’t always the best either. With that in mind, try them all out. Always be skeptical of what you hear, and fact-check the key points before deciding on your repayment strategy, whether you’re pursuing forgiveness or paying off loans ASAP.

Unfortunately, finding the best answer almost always takes some legwork.

For a fellow human who is worried about the possibility of letting you down, email the writer at [email protected].

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here