Pensions and 403(b) plans represent two distinct ways to save for retirement, each with its own structure and advantages. A pension provides a predictable income stream in retirement, usually funded and managed by an employer. A 403(b), on the other hand, relies on employee contributions and investment growth, giving individuals…

When you think about estate planning, wills, trusts and life insurance usually top the list. But annuities deserve a spot in the conversation, too. Beyond providing reliable income in retirement, annuities can ensure your spouse keeps receiving steady checks, transfer wealth to heirs and help sidestep probate. Still, annuities come…

I’m 63 With $1.35 Million in My IRA and a $2,200 Social Security Check. What’s My Retirement Budget?

By your 60s, most of your retirement foundation is already in place. While you may still have a few years to save, building significant new wealth is less likely unless you continue working during retirement. This stage typically shifts focus to taxes, withdrawals, Social Security and budgeting. To help you…

Getty Images / Win McNamee / Staff Key takeaways The Federal Reserve’s September rate cut is likely the beginning of lower yields on CDs and other deposit accounts. Locking in a CD now can secure today’s higher rates, which are still outpacing inflation. Don’t rush to put money into a…

Personal Finance

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

If a society is going to make intelligent choices in policy, it helps to understand reality, which includes facts and…

New York startup Casap has raised $25 million in new funding to help banks tackle the thorny problem of credit…

Featured Articles

Life throws curveballs. And often those curveballs mean you’re spending your hard-earned savings or you’re borrowing money instead. It can feel like a catch-22: Creating savings should help you avoid costly borrowing, but spending it equals losing it and going back to square one. So…

Dept Managmnt

Key takeaways A divorce decree outlines which spouse is legally responsible for each debt after the divorce is completed. States either have community…

Banking

When it comes to selling coconut water to the health obsessed, New York’s Vita Coco has served up a master class, schooling even…

Credit Cards

All News

Key takeaways Personal loans can help cover personal expenses once you exhaust student loans. Personal loans feature fast funding times and attractive rates, but they are often more expensive and lack the perks of student loans. Weigh the pros and cons of each option to make an informed decision. Taking…

An option is the right, but not the obligation, to buy or sell a stock (or some other asset) at a specific price by a specific date. An option has a definite life, with a fixed expiration date, after which its value is settled among options traders, and the option…

Key takeaways Debt relief companies can carry serious risks, like long-term credit damage, especially if your creditors don’t agree to work with them. Alternatives to debt relief include working with a credit counselor, negotiating with your creditors, consolidating your debt and tapping into the equity you’ve built up in your…

Key takeaways A high credit score and income are crucial to qualifying for the lowest rates on a personal loan. Improving your score before applying for a personal loan could help you secure a lower rate. Shopping for the best rates with at least three lenders or on a marketplace…

Key takeaways A trust can help minimize your taxes, protect your assets and spare your beneficiaries the hassle of probate court in the wake of your passing. A living, or revocable, trust can still have changes made to it once it has been established. In contrast, an irrevocable trust cannot…

EmirMemedovski/Getty Images Key takeaways Mortgage brokers act as go-betweens for homebuyers and lenders, matching borrowers with financing providers. Brokers can find and offer borrowers various options, including unconventional loans and loans from banks that don’t directly work with the public. It’s important to interview brokers and understand their specialties and…

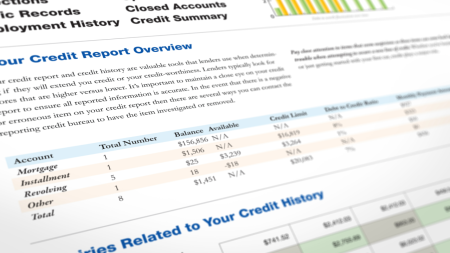

Key takeaways Accounts that have been closed for years often remain on your credit report. Closed accounts with a history of on-time payments may continue to boost your credit score slightly. You can try to remove closed accounts from your credit profile by asking a creditor for a “goodwill removal”…

Key takeaways Cardholders can use their Capital One miles to “erase” eligible travel purchases from their credit card statements. Each Capital One mile is worth 1 cent each when redeemed for statement credit, meaning 1,000 miles can erase a $10 qualifying travel purchase from your bill. You must redeem rewards…

Image by GettyImages; illustration by Bankrate Halfway through the year is the perfect time to pause, reflect and realign your financial intentions. Life changes — new jobs, unexpected bills, health changes or economic uncertainty — can impact the pace and direction of your debt payoff plan. Pausing to reassess is…

Key takeaways Evictions don’t appear on your credit report, but they still have the potential to hurt your credit. If a landlord sends your unpaid rent to collections, you could see a significant drop in your credit score. The collections item could remain on your credit report for seven years,…