Key takeaways Emergency loans can help cover a wide range of unexpected expenses when you don’t have enough savings. There are different types of emergency loans, including installment and revolving options. Personal loans and personal lines of credit offer lower interest rates and more flexibility. Payday and title loans have…

Key takeaways International students can get credit cards, but you’ll likely need an ITIN or someone who’ll let you become an authorized user on their card. A U.S. bank account can help, too. If you’re under 21, you’ll need an adult co-signer or a way to prove you can repay…

Key takeaways Your starting credit score depends on your initial credit activity; there is no standard starting point. You need at least one open account with one to six months of activity reported to receive a FICO score or VantageScore. Building healthy credit habits early on will help you start…

Key takeaways In most cases, homeowners insurance policies do not cover mold damage as it’s often tied to home maintenance. Homeowners insurance policies may provide coverage to remove the mold as part of the mitigation effort to restore your property from a covered peril. Mold claims are paid out on…

Personal Finance

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

If a society is going to make intelligent choices in policy, it helps to understand reality, which includes facts and…

New York startup Casap has raised $25 million in new funding to help banks tackle the thorny problem of credit…

Featured Articles

Key takeaways A divorce decree outlines which spouse is legally responsible for each debt after the divorce is completed. States either have community property or common law marriages, and these laws determine how marital debt is split after divorce. The divorce settlement agreement doesn’t override…

Dept Managmnt

How First-Year Students Should Manage Credit Cards Responsibly Understanding how first-year students should manage credit cards responsibly means creating a clear system around…

Banking

When it comes to selling coconut water to the health obsessed, New York’s Vita Coco has served up a master class, schooling even…

Credit Cards

All News

Get this: 55 million households are swimming in the deep end of credit card debt.1,2 Many of those are probably looking at credit consolidation as a way out. But the problem is . . . the way out really isn’t the way out. It only leads you further into the…

Have you seen all the headlines about colleges giving out cash to students and wondered what the heck is going on? It might sound like a scam at first, but it’s not. If you’re in college right now, listen up—cash could be coming your way thanks to a little something…

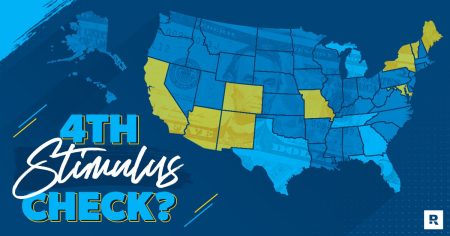

It seems like every time a stimulus check goes out, there’s a five-second pause before someone starts asking, “So . . . will there be another stimulus?” (Reminder: The third stimulus check went out in March 2021). If you’re one of those people who has been wondering if a fourth stimulus will happen, we’ve…

Do you own anything? If not, you can stop reading. But… if you have physical possessions, and you’re renting, you need renters insurance. Renters insurance is a great (and cheap!) way to protect your stuff and your finances. Because let’s face it. It would be super expensive to replace all…

So you’re dreaming of moving to Texas—and what’s not to love? You can rock out at free live music venues in Austin, cheer on the Dallas Cowboys, remember the Alamo at the Alamo, and eat all the brisket and Tex-Mex your heart desires. If you want to know if you…

Have you ever had conversations with your grandparents about the good ole days? Back then, Grandpa could take Grandma to dinner and a movie for less than two bucks, a gallon of milk cost just 75 cents, and they bought their first home for less than $10,000.1,2,3 These days, those…

If you’re anything like me, then you love food. And if you’re anything like most Americans, then food is what you probably overspend on the most each month. Maybe you want to rein in that grocery budget, but you worry you can’t eat well while saving money. Hey, eating healthy and living…

When it comes to money, you’re either a spender or a saver, a free spirit or a nerd, an experience junkie or a lover of things . . . these are all tendencies that show up in the way we deal with our money. And while it helps to know…

Insurance . . . it can feel complicated and confusing. You just want to make sure your family is taken care of, but then you start running into a bunch of insurance jargon—and all the options start running together. It seems like the insurance companies make it as difficult…

There’s an old saying—caveat emptor, or “let the buyer beware” in Latin. What exactly should you beware of? Well, whether you know it or not, you’re being targeted every day by companies who want you to buy now and think later. And they’ve come up with some pretty clever ways…