For the first time in nine months, the Federal Reserve looks ready to cut interest rates. It might not be the cure to painfully high borrowing costs that many Americans have been waiting for. Policymakers are expected to trim their key borrowing rate by a quarter of a percentage point…

Image by Getty Images; Illustration by Bankrate Key takeaways Prequalification lets you view your predicted loan rates and approval odds without impacting your credit score. Review each lender’s minimum acceptance criteria and loan terms prior to filling out the application to increase your chances of prequalifying. Prequalify with multiple lenders…

Planning for retirement often comes with questions about when and how you can tap into your savings. One such question many people ask is, “Can I withdraw from my 457 while still employed?” Unlike other retirement accounts, 457 plans (also known as 457(b) plans) have their specific rules and exceptions…

The Show-Me State has a little something for everyone, whether it’s the barbecue scene of Kansas City, the historic charm of St. Louis or the natural beauty of the Ozarks. And unlike many states, Missouri’s housing market still offers a level of affordability that can make homeownership a reality. As…

Personal Finance

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

If a society is going to make intelligent choices in policy, it helps to understand reality, which includes facts and…

New York startup Casap has raised $25 million in new funding to help banks tackle the thorny problem of credit…

Featured Articles

Key takeaways In most cases, homeowners insurance policies do not cover mold damage as it’s often tied to home maintenance. Homeowners insurance policies may provide coverage to remove the mold as part of the mitigation effort to restore your property from a covered peril. Mold…

Dept Managmnt

Key takeaways A divorce decree outlines which spouse is legally responsible for each debt after the divorce is completed. States either have community…

Banking

When it comes to selling coconut water to the health obsessed, New York’s Vita Coco has served up a master class, schooling even…

Credit Cards

All News

Update as of June 2023: Federal student loan payments will resume October 2023—with interest starting back September 1, 2023. Unless you’ve got a crystal ball, you probably never would have guessed how crazy things would get over the past few years. It’s been a whirlwind of change for sure! And…

10’000 Hours/Digital Vision/Getty Images If you tend to skip over local or cable channels and head straight to YouTube, Netflix, Disney or another streaming platform on your TV, there’s a credit card for you. Streaming services account for almost 45 percent of Americans’ TV watching, according to the latest Nielsen…

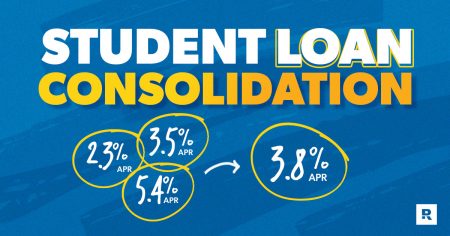

If you’ve got student loans hanging over your head, you know just how hard it can be to pay them off—especially if you’ve got an interest rate higher than the Empire State Building slowing down your progress. But one way you can accelerate your debt payoff—and save yourself a ton…

Key takeaways When you buy mortgage points, you pay your lender an upfront fee in exchange for a lower interest rate. Typically, one point costs 1 percent of the amount you borrow and reduces your interest rate by 0.25 percentage points. If you expect to live in the home long…

Cryptocurrency’s rapid appreciation has many investors questioning the place of stocks in their portfolios. But there are numerous differences between stocks and cryptocurrencies. The most important is that a stock is an ownership interest in a business (backed by the company’s assets and cash flow), whereas cryptocurrency, in most cases,…

One day you’re walking across a stage in a cap and gown to receive your hard-earned diploma. And the next you’re forking over a chunk of your new paycheck to student loans. While you can’t go back in time and tell your freshman self to avoid student loans (and to…

Drazen Zigic/iStock / Getty Images Plus/Getty Images Citi is an advertising partner. Key takeaways Both the Citi Custom Cash® Card and Bank of America® Customized Cash Rewards credit card offer plenty of cash back with no annual fee and an intro APR on balance transfers and purchases. The Citi Custom…

Whether you’re a die-hard Christmas fan or you just want to make it through another painstaking family dinner, the holiday season can have some stressful moments. Between trying not to bust the budget on Christmas shopping, listening to Uncle Bobby’s conspiracy theories again, and navigating everyone else’s holiday expectations, the…

Key takeaways If you have a solid credit score, manageable debt load and steady income, you could be in a good position to buy a house. However, you’ll also need to have enough money set aside for a down payment and closing costs. Before buying, make sure you’re ready…

Christmas is the season of giving, but that doesn’t have to mean giving more of your money to your insurance company. Yes, we’re going to talk about insurance at Christmas because nothing fills the heart with good cheer like thoughts of dying, crashing your car, your house catching on fire,…

Editor's Pick